43 how does zero coupon bond work

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero-Coupon CDs: What They Are And How They Work | Bankrate How do zero-coupon CDs work? You'll pay a discounted price for a zero-coupon CD in exchange for not being paid interest throughout the term. You'll receive the full face value of the CD, plus all...

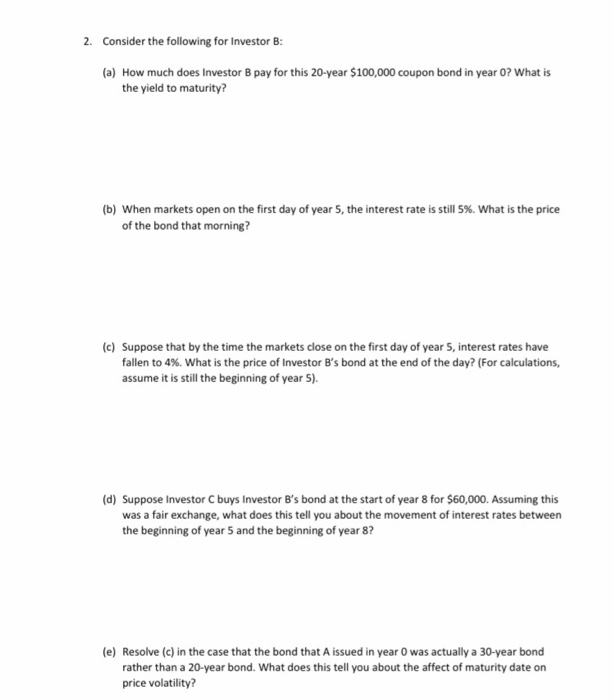

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly if the Fed raises interest rates. They also ...

How does zero coupon bond work

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. How does a zero coupon bond work? | AnswersDrive Zero-coupon bondholders gain on the difference between what they pay for the bond and the amount they will receive at maturity.Zero-coupon bonds are purchased at a large discount, known as deep discount, to the face value of the bond.A coupon-paying bond will initially trade near the price of its face value. Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

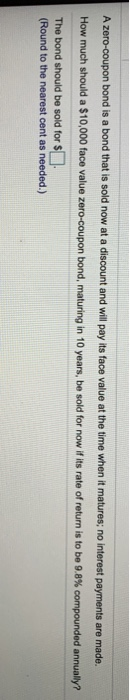

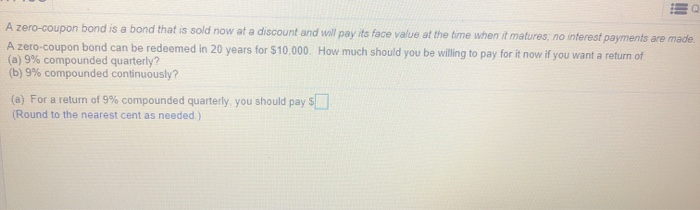

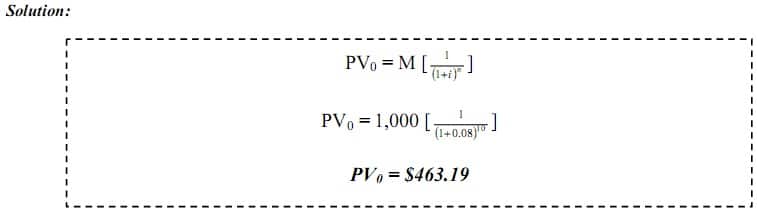

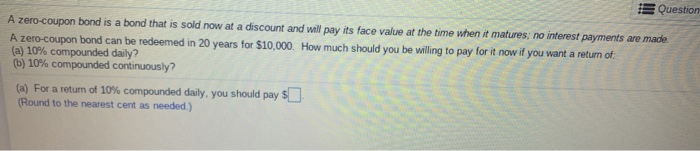

How does zero coupon bond work. What is a Zero-Coupon Bond? - Robinhood Democratize finance for all. Our writers' work has appeared in The Wall Street Journal, Forbes, the Chicago Tribune, Quartz, the San Francisco Chronicle, and more. Definition: A zero-coupon bond is a type of debt security that trades at a discount and where the only payment occurs when the bond reaches maturity. Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t ... Zero-Coupon Bonds - Accounting Hub The formula to calculate the market value of the zero-coupon bond is: Price = M / (1+r) n Where M = face value or maturity value of the bond R = required rate of interest N = number of years Suppose a bond issuer needs to issue a zero-coupon bond with a face value of $10,000 with 10 years of maturity. The investors' expected rate of return is 5%. What Is a Zero-Coupon Bond? | The Motley Fool Understanding zero-coupon bonds. Zero-coupon bonds make money by being sold to investors at substantial discounts to face value. Zero-coupon bonds compensate for not paying any interest over the ...

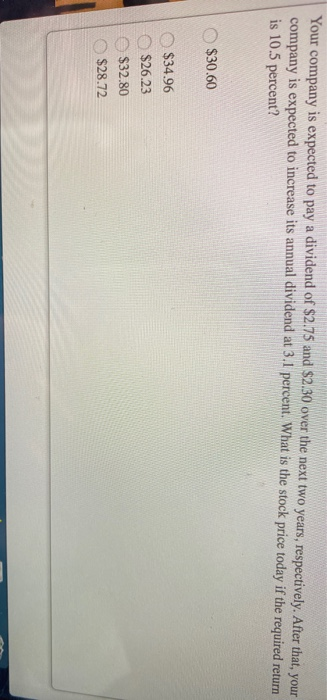

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... How Do Zero Coupon Bonds Work? - SmartAsset Jul 26, 2019 · A zero coupon bond doesn’t pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ... What Is a Zero-Coupon Bond? | The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able... Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder ... What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

How does a zero coupon bond work? | AnswersDrive Zero-coupon bondholders gain on the difference between what they pay for the bond and the amount they will receive at maturity.Zero-coupon bonds are purchased at a large discount, known as deep discount, to the face value of the bond.A coupon-paying bond will initially trade near the price of its face value.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

.jpg)

Post a Comment for "43 how does zero coupon bond work"