44 ytm and coupon rate

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author Recent Posts Ian Search DifferenceBetween.net : Help us improve.

Yield to Maturity vs Coupon Rate: What's the Difference The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates. You need to know the coupon rate, the price of the bond, its value, and the maturity date to calculate the YTM. If you purchase the bond at face value, the YTM and the coupon rate are the ...

Ytm and coupon rate

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Current Yield vs. Yield to Maturity: What's the Difference? If the bond is purchased at a discount, the current yield is higher than the coupon rate, and lower than yield to maturity. If the bond is purchased at a premium, the current yield is lower than the coupon rate and higher than the yield to maturity. 1. Yield to maturity is the rate of return of the entire bond cash flow, including the return of ... Yield To Maturity Vs. Coupon Rate: What's The Difference? Comparing Yield To Maturity And The Coupon Rate Yield to Maturity (YTM) The YTM is an estimated charge of return. It assumes that the customer of the bond will maintain it till its maturity date, and can reinvest every curiosity cost on the similar rate of interest. Thus, yield to maturity contains the coupon charge inside its calculation.

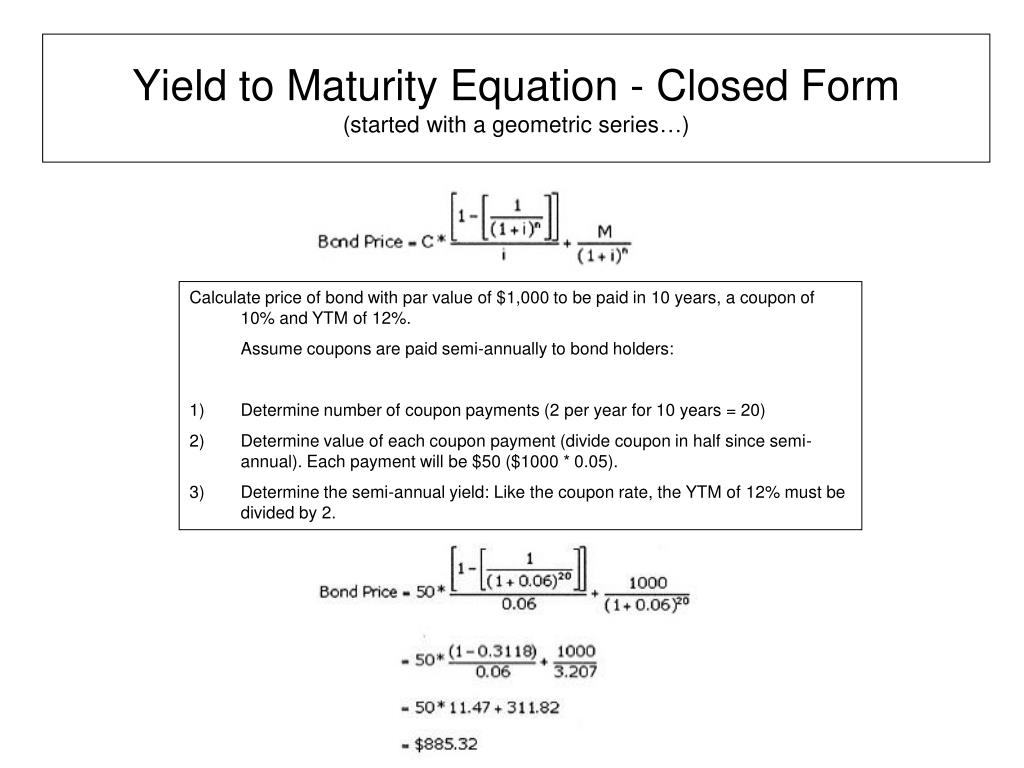

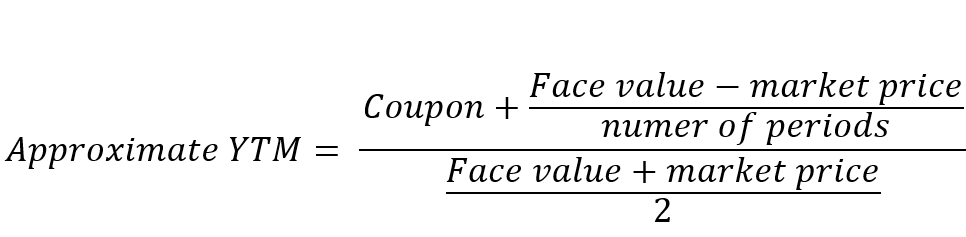

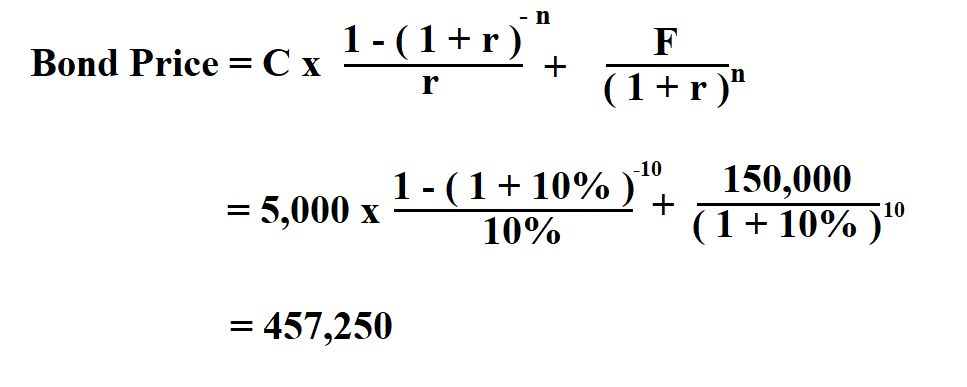

Ytm and coupon rate. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for... Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Yield to Maturity Calculator | Calculate YTM The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the principal; r - YTM ...

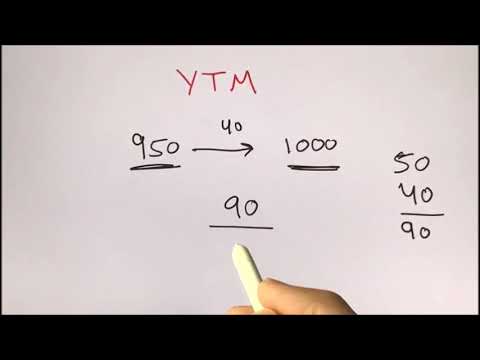

Yield to Maturity (YTM) Definition - Investopedia Yet, unlike current yield, YTM accounts for the present valueof a bond's future coupon payments. In other words, it factors in the time value of money, whereas a simple current yield calculation... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Yield to Maturity (YTM) - Meaning, Formula & Calculation Since the bond is selling at a discount, the interest rate or YTM will be higher than the coupon rate. Using the YTM formula, the required yield to maturity can be determined. INR 950 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 40/ (1+YTM)^3+ 1000/ (1+YTM)^3 We can try out the interest rate of 5% and 6%. Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded.

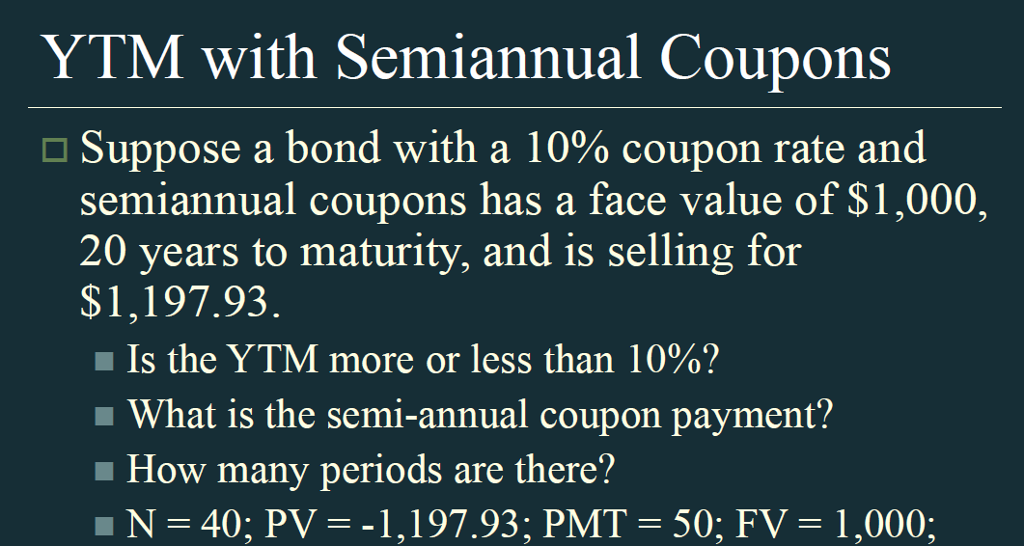

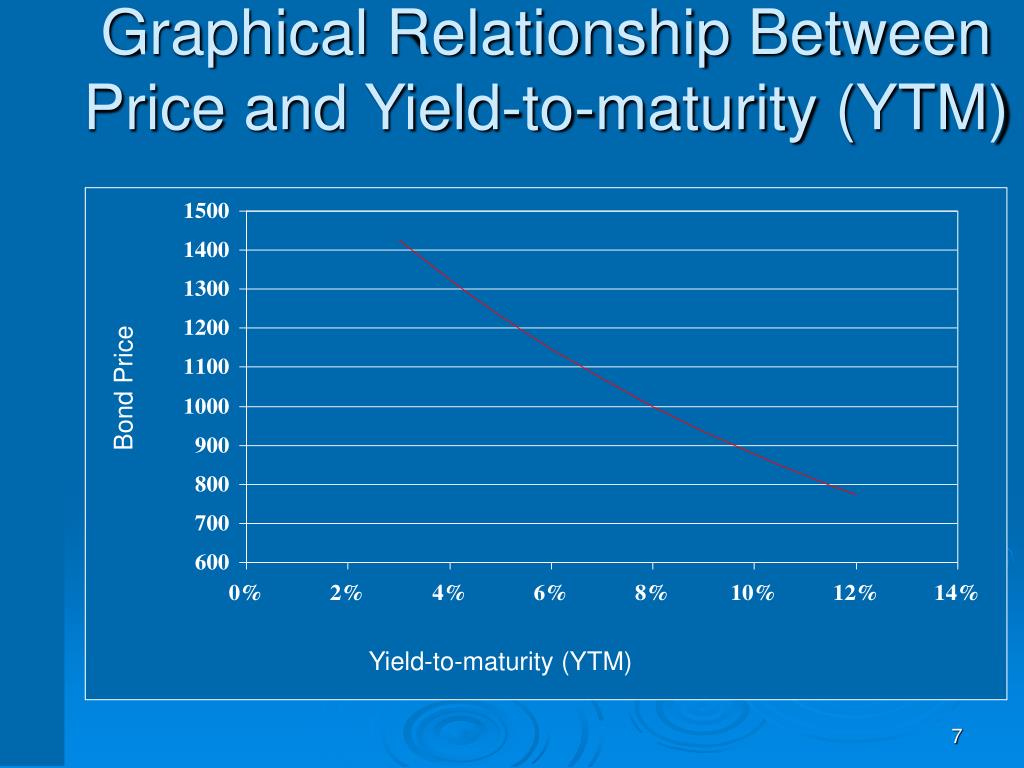

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate Valuing Bonds | Boundless Finance | | Course Hero The Yield to maturity is the internal rate of return earned by an investor who bought the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule. Yield to maturity (YTM) = [(Face value/Present value)1/Time period]-1. Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... Coupon Rate - Meaning, Calculation and Importance - Scripbox Know the Difference's between Coupon Rate & YTM. The main distinction between the coupon rate and YTM is the return estimation. The coupon rate payments are the same for the bond tenure. While the yield on maturity varies depending on various factors such as the number of years till maturity and the current trading price of the bond.

Calculating Cost of Debt: YTM and Debt-Rating Approach The yield to maturity is the annual return from an investment purchased today and held till maturity, i.e., it is the rate at which the current market price of the bond is equal to the present value of all the cash flows from the bond. ... Coupon: 8%: Coupon payment: Semi-annual: Maturity: 10 year: The YTM will be the rate at which the present ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Yield to Maturity (YTM): Formula and Excel Calculator An important distinction between a bond's YTM and its coupon rate is the YTM fluctuates over time based on the prevailing interest rate environment, whereas the coupon rate is fixed. Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value.

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

What is the relationship between YTM and the discount rate of a bond? The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters.

Yield to Maturity (YTM) - Definition, Formula, Calculations The annual coupon rate is 8%, with a maturity of 12 years. Based on this information, you are required to calculate the approximate yield to maturity. Solution: Use the below-given data for calculation of YTM We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80.

Yield to Maturity (YTM) - Meaning, Formula and Examples Here YTM will be higher than the coupon rate, which is 8%. If the bond is selling for a higher price than the face value, this means the interest rate in the market is lower than the coupon rate. This indicates that the YTM is lesser than the coupon rate. Current Yield

Difference between YTM and Coupon Rates The formula for calculating YTM is as follows: YTM = [ (C/P) (1/n)]- [ (1+ (C/P))^ (-nYTM)] in which C equals annual coupon payments, P equals the price of the bond, n equals a number of compounding periods per year, and t equals a number of years until maturity.

What is the difference between YTM and coupon rate? The bond is currently priced at a discount of $95.92, matures in 30 months, and pays a semi-annual coupon of 5%. Therefore, the current yield of the bond is (5% coupon x $100 par value) / $95.92 market price = 5.21%. What is the semi-annual coupon?

Yield To Maturity Vs. Coupon Rate: What's The Difference? Comparing Yield To Maturity And The Coupon Rate Yield to Maturity (YTM) The YTM is an estimated charge of return. It assumes that the customer of the bond will maintain it till its maturity date, and can reinvest every curiosity cost on the similar rate of interest. Thus, yield to maturity contains the coupon charge inside its calculation.

Current Yield vs. Yield to Maturity: What's the Difference? If the bond is purchased at a discount, the current yield is higher than the coupon rate, and lower than yield to maturity. If the bond is purchased at a premium, the current yield is lower than the coupon rate and higher than the yield to maturity. 1. Yield to maturity is the rate of return of the entire bond cash flow, including the return of ...

Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year.

![[70% Off Discount] YTCockpit Coupon & Promo Code – Aoo Coupon Codes ...](https://www.aoocoupon.com/wp-content/uploads/2019/09/YTCockpit-Coupon.png)

Post a Comment for "44 ytm and coupon rate"